Precisely monitoring accrued bills is crucial for your small business’s monetary well being. These expenses characterize real liabilities, directly impacting your financial statements and influencing your cash circulate. Leveraging know-how and accounting software can considerably streamline this process. Many solutions offer options particularly designed for monitoring and automating accruals, improving accuracy, and releasing up your time for other necessary duties. Beyond fundamental spreadsheets, consider exploring options like QuickBooks or Xero that combine with other monetary techniques, making a more unified and efficient workflow. The proper accounting software program could be a game-changer, so discover choices that fit your corporation measurement and budget.

Other examples embrace salaries earned by workers however not yet paid, or curiosity accumulating on a mortgage. For a deeper dive into managing funds, discover FinOptimal’s managed accounting companies. Accrual accounting is a crucial element for the financial management and development of your small business.

This estimation process may be difficult, and the estimated quantity may differ from the actual amount due. This discrepancy can result in adjustments in a while and probably affect your financial reporting. Often reviewing and updating your estimations as extra info becomes available might help minimize these discrepancies.

- This chapter will introduce you to the core ideas of accrual accounting, serving to you grasp its significance and the means it differs essentially from money accounting.

- Overlooking them can lead to a skewed perspective of your finances and ultimately impression essential enterprise choices.

- An accrued expense occurs when an organization buys provides but hasn’t received the invoice yet.

- This information on accrual expense examples provides a sensible start line.

Accrued Curiosity On Loans

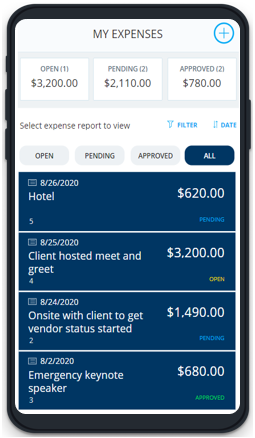

In truth, all public companies use accrual accounting since they need to adjust to GAAP, which doesn’t enable the cash foundation. By recognizing accruals, corporations in all industries can ensure correct matching of bills with the income they generate. Accrued bills (also often identified as accrued liabilities) are expenses you’ve racked up however haven’t paid for yet. You loved the cheesy goodness now, but your wallet feels the hit later. The accrual technique blurs cash circulate by together with non-cash transactions that have not affected bank accounts and usually are not proven in financial institution statements. Next, calculate the correct quantity that must be accrued for every expense.

For more complicated accrual calculations or when you’re on the lookout for skilled assistance, contemplate FinOptimal’s accruer software and managed accounting providers. An accrued expense, also referred to as an accrued legal responsibility, is an accounting time period that refers to an expense that’s recognized on the books earlier than it is paid. The expense is recorded in the accounting interval by which it is incurred. Since accrued expenses characterize a company’s obligation to make future money payments, they are proven on a company’s steadiness sheet as present liabilities.

This framework rests on core principles designed for correct and timely expense recording. Accrual accounting, a cornerstone of GAAP, mandates recognizing expenses when they’re incurred, no matter when money adjustments arms. This provides a extra full picture of a company’s financial obligations. Correct accrual accounting relies on everybody following constant procedures. Not all workers have a deep understanding of accrual accounting principles.

Accruing expenses properly will assist you to make higher decisions about money move management, budgeting, and financial planning, ultimately contributing to your company’s success. Accrued payroll refers again to the unpaid compensation that the employer owes to employees for providers already supplied. On the opposite hand, deferred compensation refers to a portion of an employee’s earnings that is deliberately set aside and paid out in future money funds.

This apply provides a extra complete picture of your company’s monetary obligations. A firm pays its employees’ salaries on the first day of the next month for services received in the prior month. A firm usually makes an attempt to book as many actual invoices as it may possibly during an accounting period earlier than closing its accounts payable (AP) ledger. Then, supporting accounting employees analyze what transactions/invoices might not have been recorded by the AP staff https://www.simple-accounting.org/ and e-book accrued bills. In accrual accounting, you record revenues and bills when they are earned or incurred, no matter when money is received or paid out.

Comparability To Cash Foundation Accounting

Accrual accounting presents a more accurate measure of a company’s transactions and occasions for every period. Cash foundation accounting typically leads to the overstatement and understatement of revenue and account balances. Where can I find extra information about accrued expenses and accrual accounting? FinOptimal offers a spread of sources, together with articles and guides on varied accounting matters, together with accrued bills. You can also discover on-line courses, tutorials, and webinars offered by accounting companies. Professional organizations just like the AICPA and IMA present valuable resources and persevering with schooling alternatives to deepen your understanding.

Managing Accrued Bills Successfully

These could be categorized as routine/recurring or infrequent/non-routine, relying on the character of the enterprise and its operations. Accrual accounting, whereas offering quite a few benefits, additionally presents distinctive challenges. This final chapter supplies you with finest practices to maximize the benefits of accrual accounting and methods to keep away from widespread pitfalls. These are notes about cash you’re owed, like for tutoring you’ve done however haven’t been paid for yet, or bills you owe, like for supplies you got however haven’t paid for. During a project I managed years ago, switching to accrual revealed hidden liabilities that cash tracking missed, preventing a nasty shock at tax time.